Payday Loans And You - Important Guidance

Payday Cash Loans And You Also - Important Suggestions

Sometimes, an accident, accident or house servicing emergency could cost considerably more than your funds can deal with. In case you have terrible need to have and credit history money easily, a payday loan could be the right choice for you. Payday cash loans might be the only option you have. These write-up provides you with valuable info on online payday loans.

Make sure you comprehend any secret service fees which may be concerned. These charges can creep through to you, so always find out what these are. A lot of people may realize that their service fees are greater than predicted after they've presently signed the payday advance. Should you browse the okay printing and question nearly anything you may not understand, it is possible to steer clear of issues like this.

Those who are encountering a financial crisis can turn to online payday loans to get short-term cash. You need to know what you're engaging in prior to agree to take out a cash advance, although. Such high interest rates associated with payday cash loans could make them hard to pay back.

Validate any ensures your paycheck lending company may placed forth. A lot of these firms can appropriately be known as predatory. Many payday advance firms earn money by loaning to inadequate individuals that won't have the ability to pay back them. Though these companies make promises, they generally have loop openings to have all around them.

Prior to credit dollars, you should know the problems and conditions of your loan. The client needs to be utilized. Which is a pre-qualification of several payday advance lenders. This is to make sure you pays the money away.

Only take care of payday creditors offering direct deposit possibilities. The amount of money will be transmitted straight into your checking account, often inside of one day. This is very easy to aids and do you stay away from possessing a ton of money on your own particular person.

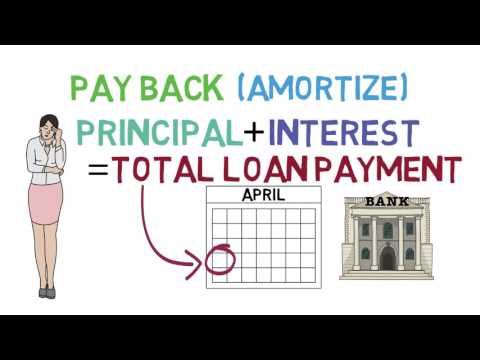

Consider the calculations and understand what the expense of your loan will be. It's frequent expertise that rates for online payday loans are incredibly substantial. You might not know, even so, that we now have administration fees a lot of creditors will fee. Those handling fees are generally revealed only within the fine print.

In terms of payday loans, perform some searching about. Loan companies fee diverse rates and costs. Probably you come across a website that seems sound, only to realize a better one particular does really exist. Don't go with 1 firm until finally they have been completely researched.

When budgeting to repay your loan, generally fault along the side of caution along with your bills. You cant ever think that it must be alright to skip a repayment without significant penalties. Pay day shoppers generally pay back twice the quantity they obtained before moving off on their own. Remember this as you develop a budget.

Require a second to think with the consequences before you take a payday advance. APR costs may vary from 300-800%! Look at because you will have to pay out about $125 have a financial loan for $500 just for 14 days. Should you totally have zero other available choices, you might need to choose that it is really worth the selling price you may pay.

It is important to remember that a pay day loan ought to be applied only like a brief-word answer. Discover more about financial debt counseling and spending budget administration if you discover yourself in awful fiscal conditions frequently.

Don't consider your credit ranking while searching for paycheck loan companies. Cash advance suppliers simply want to verify your career and cash flow and make sure they may access money through your salary. Many don't even use credit checks. They only use affirmation and may then offer you approximately $700 based off of that details.

Payday cash loans gives you a great chance to organize and handle your hard earned dollars. Make sure you took the additional cost of the loan under consideration when preparation you spending budget to make sure things are going to function in your favor. This loan could actually be a sound fiscal determination in the long run. Just make sure to apply your head.

Which is why you should do your research before choosing one particular, there are many payday advance organizations available. Start exploring a paycheck lender from the Better business bureau, or Greater Business Bureau. Any grievances up against the firms is going to be on their site.

Although some personal loan options do not require you to give documentation ahead of time, you will surely get some unfavorable capabilities in financial loans like this. You need to spend much more for getting them speedier. The charges and such is going to be extremely high comparitively.

You must carefully study on the documents, before signing for a financial loan. Examine the fine print and don't be timid about asking plenty of inquiries with customer satisfaction. If there is whatever you don't comprehend, or else you locate sneaky fees, then consider trying to find another payday loans online pay day loan provider to do business with.

You need to make sure you're selecting a really trustworthy cash advance company. Shadier loan service providers usually use debt hobbyists who may possibly make an effort to frighten or even jeopardize you in case you are not able to make the obligations in a timely design. When you are unable to pay out it 100 % on time, a high quality lender will just increase to the personal loan.

Pay day loans are not meant to be utilized regularly they should be set aside simply for instances when you need cash urgently to pay for quick expenses. If you make time to understand all you need to understand the borrowed funds before hand then pay it back quickly, it could enable you to make your mind previously mentioned drinking water. Pay day loans can sometimes be a good choice, and taking advantage of the data on this page must help you make that perseverance.

The Way You Use Online Payday Loans With out Acquiring Utilized

How To Use Payday Loans Without having Obtaining Used

Pay day loans are made to help individuals who need to have dollars fast. Loan providers will enable you to obtain an accumulation money on the assure that you just pays the cash back again at a later time. Payday cash loans are rather well-known and you may find out about them beneath.

Whenever you sign up for a payday loan, you might too kiss your following income excellent-bye. The money you obtain must be able to protect your emergency and also other costs for at least two pay out intervals. Unless you get this into account, you could end up seeking an additional loan, which results in a mountain peak of debt.

Understand all costs and costs associated with a loan, before you take it. You could want and need the money, but all those costs will catch up with you! Make sure that you request a published verification of your fees. You can help to keep your payment expenditures as low as possible in the event you fully grasp each of the terms engaged.

Don't lie on your own payday loan app. It really is a offense to supply false information about a record of the variety.

If you wish to get a bank loan for your cheapest price probable, locate one that is provided by a loan company directly. Don't get indirect lending options from places where provide other peoples' money. You will need to spend a lot more in charges as the loan provider is having to pay himself some thing, way too, if you take an indirect path.

However they can be inaccessible in your town, obtain the dearest state boundary, if situations influence that you just take out a payday advance. Scenarios will often permit you to safe a fill bank loan in the neighboring status the location where the suitable rules are more forgiving. This sometimes just means 1 journey simply because they electronically recuperate their cash.

Know each of the business policies of your pay payday loans online day loan provider before you do business with them. The financing firm will insist that you have organised employment for a certain amount of time prior to they will think about loaning you cash often. It is essential that they understand you will be able to repay the funds.

If you apply for a bank loan in a paycheck website, factors to consider you will be dealing straight together with the payday advance loan companies. A lot of web sites make an attempt to get your private information then make an attempt to terrain that you simply loan provider. This is often really dangerous as you are providing this info to a 3rd party, however.

You will find agencies that can assist you when making preparations to repay your overdue payday cash loans. Their free solutions will help work out a loan consolidation or decrease monthly interest to help you get out from a vicious pay day loan cycle.

Search for a payday firm which offers a choice of direct deposit. With direct downpayment, you normally have your hard earned dollars within a day. This can be quite convenient.

If your pay day loan company requests what your bank account phone numbers are, don't panic. A number of people turn out not receiving this personal loan because they are uneasy with disclosing this info. The main reason payday creditors accumulate this info is to enable them to have their cash once you get your following salary.

Anytime getting a cash advance, remember that you ought to only go following these types of personal loans less than excessive circumstances and once you can't get a personal loan elsewhere. These personal loans can trap you within a period that may be hard to get out of. The business could use tough terminology and other slights of hand to help you to agree to a much bigger personal loan.

Paycheck lenders generally call for paperwork as part of the application for the loan method. Numerous loan providers just need evidence of earnings as well as your checking account information and facts. Question a possible lender what documentation they need from you this can accelerate the loan method.

Perform some cost comparisons for pay day loans. Cash advance organizations fluctuate in the rates of interest they have. Even though it might seem you've come across a offer that looks very good, there is likely a thing that is better yet. In no way do just about anything without the need of fatigued each of the available study.

Once you apply for this sort of bank loan, have numerous contact numbers helpful. It is vital how the payday advance firm have your mobile, residence and employer's phone numbers. The could also demand referrals.

If you are self-employed, it is essential to know that you could not be eligible for a a payday advance. Plenty of pay day loan companies will not take into account working for yourself an income source that may be reliable. When you benefit on your own, search online to get pay day loan businesses that will give money for you.

Ensure that you are aware how substantial the rates of interest might be, prior to applying for any pay day loan. It is far better to borrow funds from an individual rather than getting a pay day loan. You need to know in the best expenses, although you may nonetheless decide to take a payday loan.

Be sure you know all the possibilities while you are getting a pay day loan. Consult with your bank or credit union, your pals, along with your family members before you use getting in touch with on a business that makes payday cash loans. It is advisable to stay away from payday cash loans at all costs.

A payday advance can be a very great tool to provide usage of speedy funds, as you have discovered. They have the cash they need and spend it back again after they get compensated. Online payday loans permit consumers to acquire dollars quickly. Keep in mind everything you've learned in this article as soon as the will need comes up so that you can obtain a payday advance.

Learning When To Take Out A Pay Day Loan

Discovering When To Take Out A Pay Day Loan

Often, a monthly bill arrives if you don't have your income however. A single solution to get cash easily can be a cash advance, nevertheless these needs to be handled cautiously. In the following paragraphs, we are going to provide ideas to help you use pay day financing as being a wise monetary resource.

Be aware of the costs that come with a payday advance. It can be attractive to focus on the funds you may receive instead of think about the charges. Desire that organization gives you document evidence that contain the total amount you need to pay. Have this list prior to making software to be payday loans a number of you won't need to pay higher fees and penalties.

Before you get 1, be sure to know exactly how much your pay day loan will cost. People are surprised in the costs which come with these lending options. By no means hesitate to find out about payday advance interest rates.

Make sure to study in case the clients are respected, well before making a decision on who to get a cash advance with. You can do this on the Greater Company Bureau web site. There are lots of shady organizations who are willing to rip-off individuals who are in dire necessity of assistance. Make use of the Better Organization Bureau to ensure the paycheck loan company is reputable.

Usually, just to be approved to get a payday advance, you will find a condition that you just have a very bank checking account. Most lenders call for authorization for immediate settlement to the bank loan on its thanks date. Automated withdrawals will likely be manufactured immediately pursuing the downpayment of your respective paycheck.

Bear in mind that you have large penalties for paying out later. You could possibly want to pay out the loan promptly, but often points show up. This implies you need to know exactly what the contract involves. Late service fees can be extremely higher for online payday loans, so be sure to comprehend all charges prior to signing your contract.

You might be able to request a compact extension out of your loan provider in the event the money will not be readily available whenever your transaction is due. Many companies will let you offer an more couple of days to pay should you need it. When the extension will add to your equilibrium, examine the terminology to view.

See if you can look for a loan provider located appropriate across the state collection if you actually need a payday loan and are unable to get a single at home status. You may get privileged and discover how the status next to you has legalized online payday loans. For that reason, it is possible to acquire a bridge bank loan in this article. After as many businesses use electronic digital business banking to obtain their payments you may ideally just need to create the vacation.

You should know the payday lender's guidelines before you apply for a financial loan. You may have to are already gainfully utilized for at least half annually to meet the requirements. They would like to guarantee they will likely obtain their cash back.

Even people with a bad credit score could get online payday loans. More and more people could really benefit from a payday loan, but will not even take the time attempting to get 1, simply because they have bad credit. Numerous organizations can give a person with a task financing.

When acquiring pay day loans coming from a organization, be sure to study them on Better business bureau.org. Not all cash advance lenders are made just as. Be sure you read through verify and complaints to see exactly how the company replied.

It is vital that you receive clones of all bank loan phrases and relevant files prior to signing a contract of any type. You will find cons which are set up to offer a monthly subscription that you just may or may not want, and use the cash right from the bank checking account without you knowing.

Usually think about the additional fees and costs when planning a spending budget that includes a payday loan. It can be simple to believe you're planning to stay out a points and paycheck will be good. The truth is very much uglier, most borrowers taking out a payday loan usually pay the loan company about 200Percent of the things they required out. This is very important to consider when budgeting.

Prior to taking out financing with them, check out the company's APR. Many people make your mistake of looking at additional factors, but this is the most important because it lets you know how great the service fees you end up having to pay will be.

Once you obtain a payday loan, you might effectively discover that your best choice is to work alongside a relatively far-away loan provider. If this is the case, see if you can select one which will not need you to fax them any documentation. It is likely you deficiency a fax equipment, and several companies want actual records. This simply means you'll need to invest more funds to fax the documents around.

Pay day loans should always be thought of as a costly quick-word remedy. You may want figure out how to budget your cash much better if you consistently count on online payday loans.

Ensure that you understand how higher the rates of interest can be, prior to applying for any payday loan. Consider other options before you take out one of these brilliant personal loans, as typical interest rates range between 300-1000Percent. Even when a payday advance is the only option, you ought to nevertheless ensure you know about this truth.

If you just need a little help before you get money once more, often online payday loans are important, specifically. Payday cash loans ought to only be part of a last option and must be only be used smartly. Bear in mind the following tips for the following time you need extra cash!

What You Should Know Prior To Getting A Pay Day Loan

Things To Know Just Before Getting A Payday Advance

Receiving a paycheck move forward loan is not one thing that needs to be taken softly. If you are new to online payday loans, you might have a lot of things to discover. Like that, you'll know what you're undertaking. Continue reading to boost your education and learning about pay day loans.

For individuals who are considering by using a payday loan, it is important to comprehend whenever you have to spend it rear. Loans like these have heavens-high interest rates, and in case you fall behind in the payments, extra substantial expenses will be sustained.

In the event you have to take out a pay day loan though there aren't any creditors in your town, you could have to attend the nearest condition series. You might be able to get a loan in yet another state where personal loan is authorized. Because cash are in electronic format restored, you must not have to make multiple trip.

Only take care of payday creditors payday loans online that offer straight deposit possibilities. This simply means dollars should be inside your profile by the next day. It can be handy, and you will probably not need to walk all around with funds on you.

Only supply pay day loan companies correct information and facts. It is essential to give a reasonable evidence of your wages. A spend stub is an excellent illustration of that. Make certain they have got your appropriate phone number. If the information and facts are incorrect, it can only wind up costing you valuable time while they try to procedure the financing.

When thinking about a payday loan, attempt to discover a lender which offers flexibility in obligations in the event that unexpected monetary difficulties need to occur.. If your money occur to tumble short at settlement time, some creditors works with you, and give you an extension.

Don't dodge payday loan enthusiasts if you realise your self not able to pay the loan back again. Their enthusiasts can be frightening while they are after you. So, should you can't pay back your payday advance in full on the agreed upon payback date, you need to speak to the pay day loan provider, and discuss an extension.

Before choosing them to help you, study any type of lending organization. Never say yes to anything at all irrespective of horrible your financial situation is before you are totally conscious of all terms. You should know by pointing out broker prior to signing along with them.

It is essential to be 100 % certain that cash is going to be offered when the pay day firm plans on pulling cash from your bank account. Many people don't have a continuous revenue source. Failing to pay back again the borrowed funds punctually will lead to higher fees costs.

Do a little cost comparisons. Check out bodily and online payday loans. Opt for the firm that may demand the cheapest volume of curiosity along with the very best total package. You could end up saving a large amount of money.

Make sure you develop a good record with the pay day financial institution. So you require another personal loan, you would like to get access to the amount of money that you desire, if anything happens later on. To obtain the best from this hint, take out loans through the identical payday loan company frequently.

In the event you be self-hired, you may wind up receiving denied when hoping to get a pay day loan. Generally, cash advance firms understand personal-career to become heavy risk, and never a steady income source. This is basically the primary purpose they might reject you. Personal-hired borrowers must very first locate a lender that may take into account self-empoyment as being a trustworthy revenue stream.

Payday cash loans ought to always be considered an expensive short-phrase answer. Debt therapy must be to be able when you frequently discover youself to be requiring extra income to get you with the 30 days.

Just use companies that inform the truth about the interest charges and service fees these are recharging for online payday loans. Stay away from firms that seem to be wanting to cover up the expense of their lending options. Be certain to have enough resources on your expected day or you will have to demand much more time to cover.

Getting a payday loan can be achieved by simply going on-line. Request your pals to point a business, and look the review sites to view how other customers rate them. When you get a payday advance on the internet, you are able to usually have the resources in 24 hours or less.

It is a great idea to look at other options, before taking out payday cash loans. You could possibly acquire some dollars from a member of family or even the lender. Payday cash loans are merely acceptable with crisis situations, but you should continue to have money put away of these scenarios.

Before signing a cash advance agreement, think about if the cash you are credit is made for a true emergency. A payday loan is not an appropriate remedy for virtually any dilemma which is under a whole-blown situation. Pay day loans don't possibly need to be an alibi for keeping power over your money.

Folks who suffer from experienced difficulties with numerous pay day loan providers can report them on numerous websites on the internet. Research every financial institution you are thinking about cautiously. Look into a online payday loans firm, their track record along with their standing upright using the Far better Organization Bureau. This will tell you if your enterprise is legitimate rather than a scammer.

Since you now have read this write-up, you already know precisely how critical getting a cash advance may be. Even though earlier mentioned information and facts are important, you ought to completely study your state's regulations about online payday loans. Generally utilize the suggestions previously mentioned if you seek out a payday advance.

Your Payday Advance Questions Answered In this article

Your Payday Advance Queries Answered In this article

Nowadays, obtaining powering on charges is not hard to accomplish and will create some critical chaos in your lifetime. When you're juggling your hard earned money to help make obligations for rental, charge card credit accounts, and vehicle obligations, you might come upon tight circumstances. If you're within a limited area and contemplating a payday loan, read the subsequent write-up for many helpful tips.

There a zillion pay day loan businesses that you should select from. If this kind of bank loan is necessary, be sure you review the lender's record well before continuing. Make sure that the payday financial institution has many pleased customers. Begin by doing a search online and read over any evaluations that you discover.

There are numerous of usery legal guidelines just for guarding customers nonetheless, payday loan companies have discovered many ways to skirt these laws and regulations. Charges will amount to nullify the lowest interest rate. Because of this, the interest for any pay day loan might be astronomical.

You should be at the start and genuine on the program you're filling in if you're looking to get a payday loan. Even though you might be tempted to do this to enable you to be accredited for a sizeable volume, placing knowingly false info on the application is fraudulence, which can lead to a criminal prosecution.

In choosing a pay day loan comapny, thoroughly study them. Amongst the large field of creditors offering the service, some are definitely more equitable than others you want to cope with an earlier mentioned-table firm as their history of treating debtors relatively could be be approved. Search for critiques from past customers to discover other information.

Be familiar with how you will get punished to make your late obligations. Sometimes lifestyle becomes in the form of monetary accountability. It is recommended to read the terms of the loan so that you will know the later fees you may deal with. The past due service fees for any cash advance can be extremely high.

Once you begin the cash advance program method, be guarded relating to your personal information. Your delicate information is typically required for these loans a sociable security quantity for example. You will find less than scrupulous firms that might sell details to next functions, and compromise your identity. Make sure the validity of your respective pay day loan lender.

You have to be mindful in the documents necessary to get a pay day loan. Most payday lenders only warrant your business banking information and facts and some proof of cash flow or employment. Some do require a lot more even though. Contact ahead of time to learn the information you need to help you get it and make the procedure go clean.

It is important that you recognize the complete value of your cash advance. It's fairly common expertise that online payday loans will fee high interest rates. A lot of paycheck creditors, even so, cost big handling costs on the top of the normal interest. You'll usually find these fees trying to hide inside the little printing.

Don't be suckered by promises of automated extensions should you really struggle to repay the loan about the due day. This might be since your loan provider has renewed your loan and will go ahead and take money from the account. Most awful of most, payday loan businesses often cover these specifics in the deal. This technique of constant service fees can cause elevated debt that is certainly extremely difficult to repay. Consider your analysis and time the terms closely prior to committing.

Generally try to look for other possibilities and utilize pay day loans only like a final option. Think of visiting a credit specialist to have your financial situation manageable if you're getting fiscal troubles. By taking out a lot of payday loans, personal bankruptcy could outcome. To prevent this, established an affordable budget and learn to are living in your indicates. Pay your loans away from and you should not rely on pay day loans to obtain by.

Should you not possess the payday loans online money to pay back them, they are able to also trigger an overdraft account fee through your financial institution, Payday cash loans not only carry significant charges. A bounced check out or overdraft may add significant cost to the currently great interest charges and fees linked to online payday loans.

Make sure to do your research prior to deciding on a pay day loan. Don't think every single payday loan is identical. They normally have distinct conditions and terms. Before you get a payday advance, glance at the terms and fascination and problems rates.

Should you be contemplating acquiring a payday advance, do your research. There is huge difference in interest and costs prices from a single loan company to the next. You could see one which appears to be a good deal but there may be another loan company with a far better pair of phrases! Don't acquire something until finally you've carried out detailed analysis.

Perform your due diligence about any lender prior to signing anything at all. Should you not recognize its phrases, though you may feel you may have no alternatives, by no means take out that loan. Called much in regards to the company's background to avoid paying out greater than what you think you can expect to.

You need to know what you must pay back with all the financial loan. These lending options cost an extremely high interest rate. The money increases in cost if you fail to pay for the complete equilibrium back again by the due date.

While you are in a combine, you might have no place different to turn. In case a cash advance is the remedy you want, hopefully, you may have identified some answers from the write-up you only study, and now know. To be able to get over economic stresses, you must take action quickly and clever.